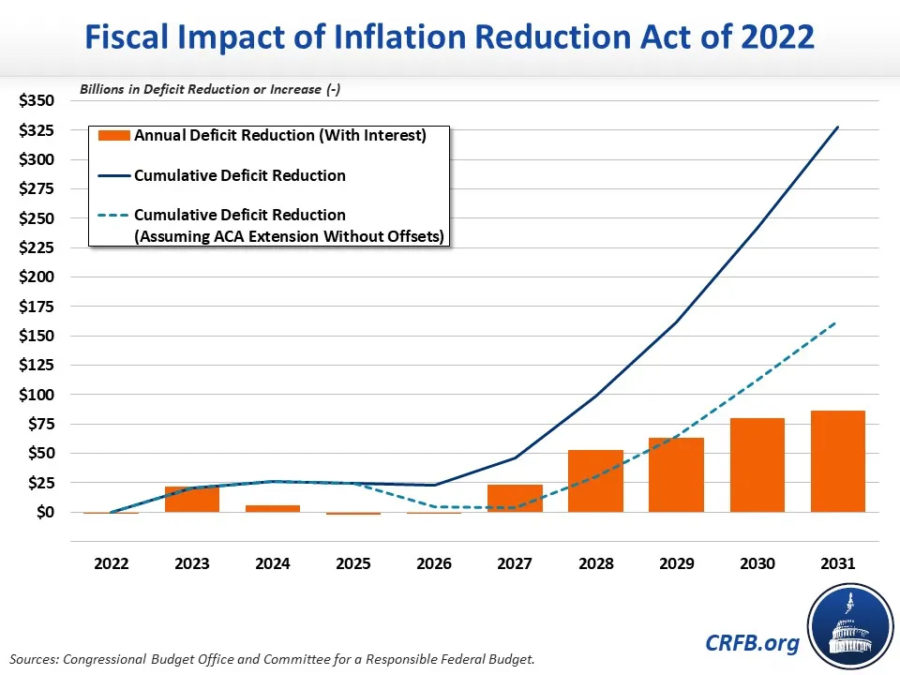

A closer look at the Inflation Reduction Act

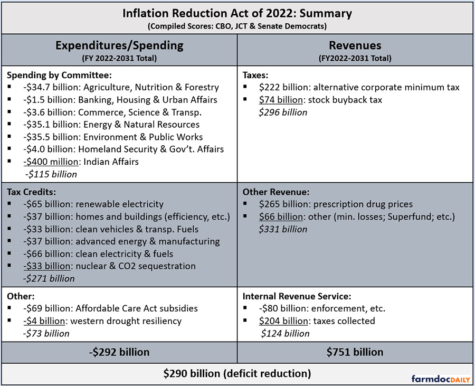

Contrary to its name, the recently passed Inflation Reduction Act seeks to accomplish a variety of goals other than just reducing inflation. Signed by President Joe Biden on Aug. 16, 2022, the Inflation Reduction Act aims to reduce the deficit, the difference between the amount of money the government takes in and how much it spends, which in turn will reduce inflation. This act affects multiple parts of the economy, including the clean energy, tax, healthcare, and pharmaceutical sectors. In the last fiscal year, the deficit from US government spending dropped by $350 billion, and with the passing of the Inflation Reduction Act, the White House expects the deficit to decrease by $1.5 trillion in the coming year. The expected deficit reduction of $1.5 trillion represents a much larger deficit drop, and over 100 economists believe that this will significantly decrease economic inflation in the United States.

In an effort to boost the American healthcare system, the Inflation Reduction Act has provisions that require pharmaceutical companies to lower the costs of prescription drugs, expand the reach of health insurance to 3 million more Americans, and cap the monthly cost of insulin at $35, which could save insulin patients about $60 to $300 per month. The act also focuses on clean energy, as $60 billion will be allocated to create millions of domestic jobs in the clean manufacturing industry, and an additional $60 billion will be set aside to reduce pollution.

Perhaps the most important issue the Inflation Reduction Act is tasked with is making the tax code fairer for all Americans, which it does by going after the top 1 percent of income earners. With the passing of the act, any family that makes a combined total of $400,000 will not have their taxes increased, providing them with an extra blanket of security in their funds. In the business sector, the minimum tax on corporate profits rose to 15 percent, and this increase is primarily enforced upon the more profitable corporations.

In a politically divided America, passing bills such as the Inflation Reduction Act can be incredibly difficult, so compromise is essential.

“The Inflation Reduction Act passed in what we call a partisan matter,” said Upper School economics teacher Matthew Munday, “which means it was [passed] along party-line votes. The bill is a major political move for the Biden administration, who, over the last six months, has been working together with leadership in the Senate to find areas of agreement … [and] this bill is basically what they could get out of [it].”

Many Americans believe that the Inflation Reduction Act is misnamed, due to the belief that it will not significantly reduce inflation.

“Biden managed to convince Joe Manchin [a Democratic senator] that [the bill] is something he could support and potentially win reelection in West Virginia [for],” said Upper School history teacher David Abraham.

Even though some expect the bill to help Americans, whether it will or not is still questionable.

“In democratic politics, naturally, you win elections by promising things to people who support you,” said Abraham. “Calling it the Inflation Reduction Act is really just something to give Joe Manchin cover in West Virginia to say he’s fighting for the reduction of inflation … [the naming] is political propaganda.”

“People from the congressional budget office looked at the bill and all its various spending provisions and its tax provisions, and they came up with the estimate that it was going to have a negligible effect on inflation generally,” said Munday.

Sreeni Prabhu, co-CEO and founder of Atlanta-based hedge fund Angel Oak, has similar thoughts on the efficacy of the bill.

“Generally, I think the act will have a small impact on the economy,” said Prabhu. “Long term this could have a good impact, but any fiscal thing that’s been done will not have a big impact on the economy.”

Both Munday and Prabhu believe that the massive environmental changes the bill makes will affect the clean energy sector.

“This spending bill is somewhere around $700 billion, which is a lot,” said Munday, “but when you think about the overall federal budget being around $5 trillion, it’s fairly small. The biggest area of spending is in clean energy, it’s around $300 billion, which will have an impact on that industry.”

“Long term, clean energy is going to do really well, especially because the bill is designed to help companies in the clean energy sector,” said Prabhu.

However, the clean energy sector is not the only sector that will be seeing a change because of this bill. The $425 billion pharmaceutical industry, for example, is notorious for marking up prescription drugs like insulin, and one section of the bill aims to reduce these markups. According to Prabhu, the markdown will initiate an argument between the government and pharmaceutical companies, who “will put less money in R&D [research and development], causing the new breakthroughs in cancer and new drugs to decline” if the prices of drugs are reduced.

Nevertheless, some impact on healthcare will still be present.

“Medicare has been given legislative approval to bargain over drug prices, and so it’s likely that prescription drug prices for people on Medicare will fall,” said Munday. “But again, that’s an isolated pocket of the general population and the general economy.”

Although there are several components of the Inflation Reduction Act that can confuse people about its purpose, Munday made clear that “it does not mean that taxes are going up on individuals or households, those tax rates have not changed; but corporate income taxes, which had previously received a pretty big cut under the Trump administration, are being reversed.”

Although the effects of the Inflation Reduction Act will likely not be felt by the average American, the impact it will have on clean energy and healthcare will undoubtedly be present.

Edited by Hazel Thekkekara